Our Property Management Services

We customize our property management services based on the property type, owner requirements, and our goal of achieving the maximum value for every client and property. Learn more about our services and how we can tailor them to meet your needs!

Portfolio & Investment

Property Management

Our Boston property management services address the specifications and investment objectives of each client. We offer a full range of management functions and tailor our services to meet our clients’ individual needs. Our team of leasing professionals—many of whom have been with us for more than ten years—is simply the best in the business!

Homeowners Association

Management

Multifamily Property

Management

With our team of multifamily specialists, investors benefit from our expertise to find and acquire new buildings. We also provide onsite management services to fit specific needs. From property maintenance to building improvements and managing tenants and occupancy, CHARLESGATE works with investors to deliver a high-quality resident experience.

Additional Services

As an integrated real estate firm that empowers thousands of clients throughout Eastern Massachusetts, CHARLESGATE offers a comprehensive array of services across residential and multifamily real estate. In addition to property management and leasing, our experts deliver sales brokerage, investment sales, construction, and new development services for investors.

Who Do We Serve?

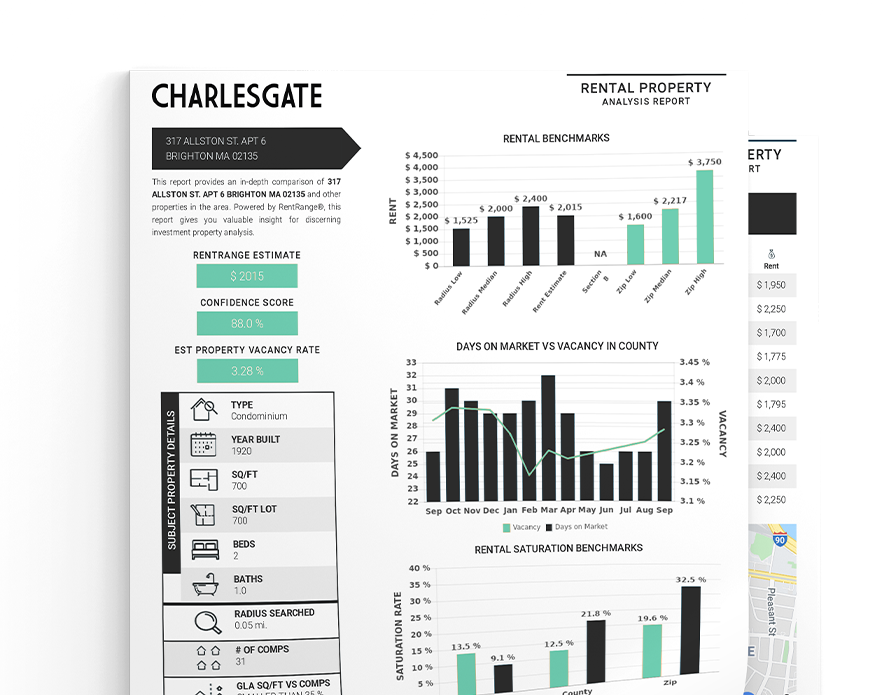

Free Portfolio Analysis

Enter the address (or addresses) of investment properties in your portfolio to get a free assessment.

- CHARLESGATE experts review your properties.

- Our team boosts your profits the CHARLESGATE way!

Ready To Get Started?

- Speak with one of our experts.

- Help us learn your goals as an investor.

- Choose a custom package based on your needs.

- Let us handle the rest!